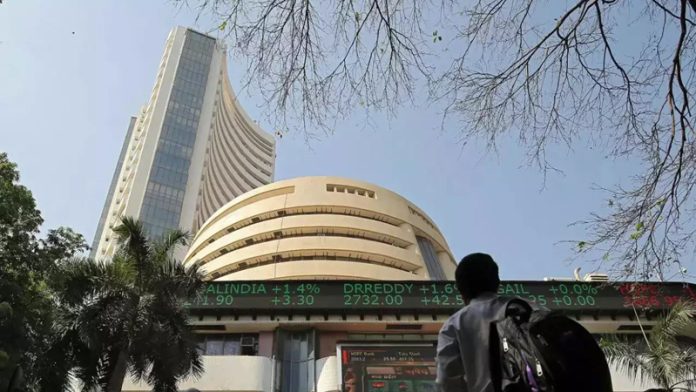

MUMBAI, Nov 1 : Equity benchmark indices Sensex and Nifty declined for the second day in a row on Wednesday amid unabated foreign fund outflows.

Investors preferred to remain on the sidelines ahead of the US Federal Reserve’s interest rate decision, traders said.

The 30-share BSE Sensex declined 283.60 points or 0.44 per cent to settle at 63,591.33. During the day, it fell 324.47 points or 0.50 per cent to 63,550.46.

The Nifty went down by 90.45 points or 0.47 to 18,989.15.

Among the Sensex firms, Asian Paints, Tata Steel, HCL Technologies, Nestle, Maruti, JSW Steel, NTPC and Larsen & Toubro were the major laggards.

Sun Pharma, Bajaj Finserv, Reliance Industries, State Bank of India and Bharti Airtel were the gainers.

“Investors continued to trade with caution and trimmed their equity exposure as markets extended fall for the second straight session amid selling in metal, power, auto and banking stocks while gains in telecom stocks curbed losses.

“FIIs offloading shares in the domestic market continues to hurt sentiment while strong US growth indicators indicate that interest rates may stay elevated going ahead. Investors sentiment was also primarily clouded by lingering concerns about corporate India’s Q2 earnings which as of now is uninspiring,” said Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd.

In the BSE midcap gauge declined 0.35 per cent and smallcap index dipped 0.10 per cent.

Among the indices, metal fell 1.45 per cent, power declined 1.19 per cent, commodities (1.18 per cent), services (1.15 per cent), utilities (1.13 per cent), IT (0.75 per cent), teck (0.63 per cent) and capital goods (0.59 per cent).

Telecommunication, oil & gas and realty were the gainers.

In Asian markets, Seoul, Tokyo and Shanghai settled in the green while Hong Kong ended lower.

European markets were trading on a mixed note. The US markets ended in positive territory on Tuesday.

Global oil benchmark Brent crude jumped 1.31 per cent to USD 86.13 a barrel.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 1,816.91 crore on Wednesday, according to exchange data.

Manufacturing activities in India decelerated in October as new orders increased at the slowest pace in a year, triggering a softer rise in output and employment, a monthly survey said on Wednesday.

The seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index (PMI) slipped from 57.5 in September to 55.5 in October, the slowest rate of expansion since February.

“The domestic indices were responding to the global signals ahead of the Fed’s monetary policy decision later in the day, while the global market was also assimilating to the mixed bag of US corporate earnings reports. Markets anticipate a status quo in the Fed policy, however, sustenance of the high rate for a prolonged period is the issue.

“Ease in demand, as reflected by October PMI data, led to more cautiousness in India compared to Asian and European peers. However, good H1 gross tax collection and in-line expectation monthly volume demand by the auto sector, resulted in a minimal negative effect,” said Vinod Nair, Head of Research at Geojit Financial Services.

GST collections in October stood at Rs 1.72 lakh crore, the second highest-ever, the finance ministry said on Wednesday.

The BSE benchmark declined 237.72 points or 0.37 per cent to settle at 63,874.93 on Tuesday. The Nifty dipped 61.30 points or 0.32 per cent to 19,079.60. (PTI)