Concessions to industry, tourism sector extended for one more year

War veterans’ allowance doubled, Fund introduced for AIDS patients

Rs 11,300 crore worth total plan, PMRP, CSS projected for 2014-15

J&K’s tax base to go up to Rs 7496 crore next year

Sanjeev Pargal

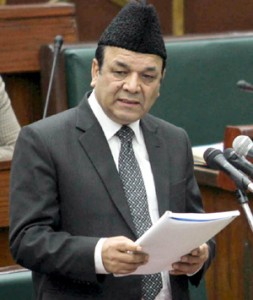

JAMMU, Feb 13: Finance Minister Abdul Rahim Rather today imposed no new taxes and made no increase in existing tax structure of any item as he presented Rs 43,543 crores worth zero deficit budget for next financial year of 2014-15 in the Legislative Assembly in which he extended the concessions to industry and tourism sector for one more year and waived off taxes on fertilizers and pesticides to benefit the farmers and horticulturists.

He pegged the plan size for next financial year of 2014-15 at Rs 11,300 crores that included the annual plan, Prime Minister’s Re-construction Plan (PMRP) and Centrally Sponsored Schemes etc. He said economy of the State was growing at rate of 5.8 per cent, about 1 per cent more than national average growth rate of 4.8 per cent.

A veteran of 14 budgets and two Vote-on Accounts, Mr Rather justified new job policy for unemployed youth and new pension scheme for the employees saying this had become imminent to check the non-plan expenditure, which has been increasing mainly on account of salaries and pensions.

Minister of State for Finance Dr Manohar Lal Sharma presented the budget in the Legislative Council.

In his 107 minutes budget speech spread over 68 pages and 165 paragraphs read in Urdu in the presence of Chief Minister Omar Abdullah and entire Opposition including PDP Legislature Party leader Mehbooba Mufti, Mr Rather said he was keeping an adhoc provision of funds in the budget for creation of new administrative units and would release the funds as and when the Finance and Planning Departments worked out the amount.

In the next financial year of 2014-15, out of Re 1, the Government would receive 53 per cent amount from Central grants, 17 per cent from own taxes, 12 per cent from share of Central taxes, 10 per cent from capital receipts and eight per cent from own non-tax. It would spend a whopping 43 per cent on salaries and pensions, 24 per cent on capital expenditure, eight per cent each on purchase of power and payment of interests and 17 per cent in Others category.

The budget, which would be last of present NC-Congress coalition Government with Assembly elections scheduled later this year and Lok Sabha elections in next couple of months, didn’t put any burden on any person, trader or industrialist but there were no freebies either, which, according to economic experts, were not possible for a State like Jammu and Kashmir, which had to spend 43 per cent of budget on salaries and pension and about 75 per cent on non-plan expenditure.

However, the Government in the year of twin elections tried to strike a balance by keeping the people in good mood by not imposing any new taxes and maintaining status quo on all existing tax structures. Denying that he was not imposing new taxes or maintaining status quo on existing taxes in view of election year, Mr Rather said in all his previous five budgets of present Government, he has refrained from imposition of new taxes excepting revision of toll on few occasions to adjust inflation and bringing few Services under the tax net.

Mr Rather announced that he was waiving off Rs 2000 crores worth liability on Public Sector Undertakings (PSUs), which they owed to the Government as return of loan given to them in the form of budgetary supports over the years. “We are waiving off entire loan as well as interest given to the PSUs over the years as budgetary support. We had conducted an exercise and worked out the amount as Rs 2000 crores,” he said describing it as a major initiative towards strengthening the PSUs. He added that the Government decision would make the PSUs “debt free”.

However, the budget revealed that J&K’s liability had gone up to Rs 40248 crores in 2012-13 as compared to Rs 16790 crores in 2005-06

Admitting increase in non-plan expenditure, Mr Rather disclosed that in the total budget of Rs 43,543 crores, there would be only about Rs 9000 crores available for capital expenditure i.e. development works while rest would be incurred on non-plan expenditure. Rs 11,900 crores (inclusive of Rs 600 crores PMRP) would be plan amount and Rs 31,643 crores as non-plan amount. The total capital component would be Rs 10,595 crores while balance amount of Rs 32,948 crores is proposed to be utilised to meet revenue expenditure. He said the budget was zero deficit as the State would match its receipts and expenditure.

Despite new job policy and new pension scheme, the Government would be spending a major part of the budget in 2014-15 on Government employees’ salaries and pension payments, which have been worked out at Rs 18,441 crores. The pension’s payments next year included Rs 3980 crores as against current year’s Rs 3673 crores. The amount also included Rs 290 crores for payment of leave encashment to the employees retiring in 2014-15.

During current year, the Government would be spending Rs 12,117 crores on salaries and allowances and Rs 3673 crores on pensions out of a total estimated revenue expenditure of Rs 27,617 crores. However, in the next financial year, the Government has kept a total provision of Rs 14,461 crores on account of salaries and allowances of the Government employees including a provision of Rs 700 crores for two DA installments, which would become due on January 1 and July 1, 2014. The Finance Minister has presumed the two DA installments at 6 per cent each though he admitted in his budget speech that the actual percentage might go up.

The Government has also included a provision of Rs 842 crores in the next year’s budget for payment of fourth installment of arrears to Government employees on account of Sixth Pay Commission.

Mr Rather said he had kept a provision of Rs 67 crores during current financial year and was keeping Rs 69 crores in next financial year for the programmes related to return of Kashmiri migrants to the Valley.

“I can’t complete my speech without remembering my Kashmiri Pandit brothers and sisters without whom the composite culture of Vitasta and Jehlum in Kashmir was incomplete. We are ceaselessly working and shall continue to work for their safe return to Kashmir with honour and dignity,” he said, adding he has kept a provision of Rs 183.24 crore for the salary of migrant employees and Rs 141 crore as cash assistance for the migrants.

He said the Gross State Domestic Product (GSDP) was estimated to reach 85,318.72 crores during the current financial year as per the advanced estimates as against Rs 75,574.31 crores during current year and Rs 42,314.84 crores in 2008-09.

Describing agriculture as backbone, he said almost entire agriculture sector has already been made tax free while he was waiving off two more taxes on fertilizers and pesticides, fungicides etc, which were charged at Lakhanpur at Rs 65 per quintal (on fertilizers) apart from five per cent VAT, which would benefit a large community of farmers and horticulturists across the State.

The Finance Minister proposed to extend the concession of VAT remission to the local industry by another year up to March 31, 2015 or till such date on which the proposed GST (Goods and Services Tax) comes into force, whichever is earlier. The exemption was due to end on March 31, 2014. He said financial implications on this account were worked out at Rs 500 crores per annum but with the passage of time, the amount might have increase to Rs 750 crores.

He also proposed cashless system of VAT remissions on purchase of raw materials by the industrial units from the next financial year. Earlier, the unit holders had to pay VAT on local purchase of raw material, which was refunded in cash to them. He proposed to clear previous backlog of VAT remissions in a phased manner in two years’ time frame.

“Due to persistent follow up by the State Government, the Union Government has finally agreed that the concessions in the Central Excise Duties shall be available to the industrial units located within the State on their second substantial expansion as well,” Mr Rather said.

He proposed reduction in the rate of VAT on handmade machine embroidered shawls, which mostly come from outside the State, to 5 per cent as against present tax rate of 13.5 per cent. He also proposed that weight of the container should be exempted from levy of toll while the containers are taken to and fro by the traders.

Mr Rather proposed to increase the limit for compulsory audit by a qualified auditor for filing of VAT returns by the dealers from Rs 60 lakh to Rs 1 crore from the current financial year. He also proposed to increase the limit from exemption in depositing VAT and filing VAT returns from Rs 7.5 lakh to Rs 10 lakh per annum and Turnover Tax limit to Rs 25 lakh per annum. He proposed constitution of an Advisory Committee on VAT implementation in addition to the Grievance Redressing Mechanism, which is already in place.

The Finance Minister proposed to extend package of incentives for all segments connected with promotion of tourism in the State by one more year up to March 31, 2015. The package was expiring on December 31, 2014. He also proposed extension in the concession in Hotel Tariff Tax on room rent collected by the hotels and guest houses for another year up to March 31, 2015.

He announced that essential commodities like atta, maida, suji, besan, pulses, paddy and rice etc would remain in the list of VAT free items for another year. This exemption would cost the State exchequer Rs 250 crore.

He proposed to revisit the prevailing system of exemption from payment of Entry Tax and try to relate the concessions to the quantum of goods locally purchased by the contractors. “The Committee of Officers, which is currently looking into entire package of industrial incentives as announce by me during last budget session shall also look into the issues related to Entry Tax exemptions and suggest appropriate remedies,” he said.

Mr Rather proposed to enhance the amount of financial assistance given to girl students of BPL families under `Beti Anmol Scheme’ at the time of securing admission in 11th class from Rs 5000 to Rs 10,000. Further, the scheme, which was confined to only 97 educationally backward blocks now would be extended to all blocks of the State. He said 8500 girl students have so far benefited from the Beti Anmol Scheme and by the end of current financial year more than 10,000 girl students would benefit from it.

He proposed to increase financial assistance paid to war veterans by the State Government from Rs 1500 per month to Rs 3000 per month. He kept a provision of Rs 2.3 crores in the budget for the increase.

The Finance Minister proposed a fund of Rs 1.40 crores beginning from the current financial year for AIDS/HIV victims and Rs 2 crore for Cancer Treatment and Management Fund.

Noting that the Government has recruited 57,000 youth in the Government jobs, Mr Rather said 13,000 more youth are likely to be recruited in next about two months.

“There is a backlog of vacancies already referred to the recruitment agencies. In this way, our goal of recruiting one lakh youth in the Government jobs may well be exceeded during next financial year,” he said. However, he justified the next job policy under which the fresh recruits were paid only stipend for first five years saying this had become necessary to check non-plan expenditure.

Announcing concessions for the farming community, Mr Rather proposed to double the present exemption limit of Rs 1.5 lakh per Kissan Credit Card for purpose of exemption from Stamp Duty. He proposed to apply the enhanced limit in Stamp Duty concession to the holders of the Artisan Cards as well.

He proposed to exempt bone-meal from the levy of VAT as well as toll on its import from outside the State saying it was being increasingly used as fertilizer as a cheaper alternative to expensive imported phosphates and potash. He recalled that all bio-fertilisers and chemical fertilizers have already been exempted from the levy of VAT and Toll.

Observing that the Government has already granted toll exemption on the export of basmati rice from the State, he proposed to extend similar toll exemption to “tootee basmati” (two piece basmati) from the next financial year on the ground that it was also in good demand outside the State but was attracting levy of toll at Lakhanpur.

Noting that he had earlier exempted import of rice bran and wheat bran from the levy of Toll as it was used for feeding the cattle, he proposed full exemption on import of husks of bran and pulses, which are also used as cattle feed but attract the levy of taxes.

Mr Rather proposed to exempt “bee wax” and oil cake from the levy of VAT and hand pumps from the VAT and Toll. He kept a budgetary provision of Rs 2 crore in next year’s budget to undertake pilot initiative on micro irrigation.

For the horticulture industry, the Finance Minister proposed Weather Based Crop Insurance Scheme on a premium sharing basis between framers, financing banks and the Government on a pilot basis to cover cash crops like apple, pear, cherry, mango, saffron and basmati at village Panchayat level on convergence with Crop Loan and Kissan Credit Card schemes.

He kept a provision of Rs 50 lakh in the budget for organizing `Krishi Darshan’ tours. He said if the members agreed, the Planning and Development Department can modify the existing Constituency Development Fund (CDF) guidelines to provide emphasis on the application of CDF towards the Agriculture sector.

The Finance Minister said he was revising the estimates to Rs 46 crores for payment of honorarium to Sarpanchs and Panchs for current year and a similar provision for next financial year. He said the Government would contribute Rs 63.44 lakh as Government’s contribution for insurance of the Panchayat members.

Pegging total budget at Rs 43,543 crores for 2014-15 in comparison to current financial year’s (2013-14) budget of Rs 36,289 crores, Mr Rather said Rs 4322 crores would be capital and Rs 39,221 crores as revenue receipts. The last year’s budget was initially stated at Rs 38,068 crores but in the revised estimates Mr Rather said it would come down to Rs 36,289 crores with revenue component at Rs 27,617 crores and capital component at Rs 8,672 crores.

“Of total capital component of the expenditure, Rs 6776 crores are proposed to be spent on the plan inclusive of the provisions under PMRP in the current year. The capital expenditure proposed on the non-plan items is Rs 1896 crore including Rs 1231 crores as repayment of the State loans,” the Finance Minister said.

The Government has kept a provision of Rs 3668 crores on purchase of power during 2014-15 as against the revised estimates of Rs 3336 crores in the current financial year. The Government would pay Rs 3470 crores worth interest on the borrowings in 2014-15 as against Rs 3300 crores in the current year.

Mr Rather said the State has decided to project a plan size of Rs 11,300 crores to the Planning Commission for next year including Rs 7305 crores as plan, Rs 600 crores as PMRP and rest under Centrally Sponsored Schemes etc. The Plan revenue component was estimated at Rs 3395 crores. However, he added, the Scheme of Financing of the Plan would under a change when the Planning Commission gives formal nod to the State’s annual plan outlay after the completion of Parliamentary elections and passing of Union budget.

“The total budget for next year has been projected at Rs 43,543 crore as against Rs 36,289 crores of present year. The breakup between capital and revenue receipts was projected as Rs 4322 crores and Rs 39,221 crores respectively,” the Finance Minister said.

He said the State’s total tax revenue during next financial year has been estimated at Rs 7496 crores as compared to current year’s Rs 6700 crores, an increase of Rs 796 crores (12 per cent). The main resources of the State’s tax revenue at VAT inclusive of GST and Service Tax levied under J&K GST Act, Passenger Tax, Stamps Duty and Registration Fee, Toll and Excise Duty. The Government hoped to collect Rs 5344 crores under VAT during 2014-15 as against Rs 1836 crores in 2008-09 when the present coalition Government had taken over.

The State has projected Rs 635 crores worth taxes from Goods and Passengers next year as against Rs 559 crores of current year and Rs 271 crores of 2008-09, Excise Duty as Rs 462 crores as against Rs 423 crores of 2013-14, Rs 324 crores under Stamps and Registration, Rs 159 crores from Taxes on Vehicles and Rs 529 crores from Electricity Duty.

Mr Rather pegged total non-tax receipts for the next year at Rs 3560.57 crores, the major share of which was projected to come from power (Rs 2979.60 crores) as against current year’s target of Rs 2840.60 crores. Other main items of the non-tax receipt are Mining and Minerals (Rs 60.10 crores), Forestry (Rs 69.52 crores), Irrigation (Rs 58.98 crores) and Water Supply and Sanitation (Rs 49.50 crores).

Mr Rather said the non tax revenue has also increased as against Rs 837 crores from 2008-09 to Rs 2160 crores during last year. The collections on account of energy charges alone amounted to Rs 1589 crores as against Rs 630 crores during 2008-09.

“The projected plan expenditure for next year is Rs 11,300 crores. An increase of Rs 500 crores has been projected over the current year’s plan size to take care of next increases in the committed plan revenue expenditure and expansion part in the State component. The expected net addition on account of transfer of Centrally Sponsored Schemes to the State Plan is Rs 3500 crores,” Mr Rather said, adding: “in the total plan budget of Rs 11,900 crores including of Rs 600 crores PMRP, the breakup between capital and revenue expenditure has been worked out at Rs 8505 crores and Rs 3395 crores respectively.

He admitted that revenue expenditure was expected to go up by about 19.3 per cent over current financial year on account of committed expenditure as well as for meeting future expansion needs.

On the Non-Plan side, the breakup between capital expenditure and revenue expenditure is Rs 2090 crores and Rs 29,553 crores respectively. On the capital side, the main item of expenditure is Rs 1297 crores on account of repayment of the State loans, Mr Rather said.

The Finance Minister proposed allocation of Rs 321.40 crores for Agriculture and Allied Departments including Animal and Sheep Husbandry, Floriculture and Cooperation, Rs 179.74 crores for Irrigation, Flood Control and PHE, Rs 106.2 crores for Tourism, Rs 179.82 crores for Industries including Labour and Employment, Rs 734.66 crores for Education, Rs 310.45 crores for Health, Rs 332.34 crores for Social Welfare including specific allocations of Rs 49.73 crores for Tribal Sub Plan and Rs 27.43 crores for SCs, Gujjar and Bakerwals, BCs and Pahari speaking people and Rs 40 crores for ICDS Mission mode including Rs 20 crores for creation of additional 1000 anganwari centres in a phased manner.

He also proposed Rs 396.21 crores for Power sector, Rs 10.25 crores for Transport, Rs 525.28 crores for PWD (R&B), Rs 423.62 crores for Housing and Urban Development, Rs 65 crores for Rural Development, Rs 25 crores for regularization of Rehbar-e-Zirat, Rs 484.42 crores for Sarv Shiksha Abhiyan, Rs 135.27 crores for Rashtriya Maadhyamic Shiksha Abhiyan (RMSA) and Rs 50 crores for Jammu, Rs 25 crores each for Ladakh and Kargil under award of Special Task Force.

Mr Rather kept a budgetary provision of Rs 3 crores to pay financial assistance of Rs 30,000 for marriage of every orphan girl belonging to BPL family. He said a total allocation of Rs 2054 crores has been proposed for District Plans for next financial year, Rs 10 crore for critical needs of bad pockets and Rs 148 crores under Border Area Development Programme (BADP). He proposed another Rs 120 crores for meeting the requirements of Seed Capital Fund, Youth Startup Loan Scheme, Women Entrepreneurs and Voluntary Service Allowance in next year’s budget.

Mr Rather said the GSDP of the State was likely to reach Rs 87,318.72 crores during 2013-14 as against Rs 75,574.31 crores in 2012-13 and Rs 42,314.84 crores in 2008-09. Similarly, he said the budgetary expenditure, which was Rs 17,012 crores during 2008-09, has reached more than double this year. The GSDP would record growth rate of 15.54 per cent this year as compared to last year.

“At constant prices, our GSDP was Rs 34,664.22 crores in 2008-09 and was now estimated to reach Rs 45,399.45 crores in the current financial year, an increase of about 31 per cent,” Mr Rather said.

He added that Per Capita Income in the State, which was Rs 63,232 during 2012-13 and Rs 30,212 in 2008-09 has increased to Rs 72,188 in the current financial year of 2013-14. Even at the constant prices, the Per Capita Income has grown to Rs 37,533 during current year as against Rs 25,641 in 2008-09, an increase of about 50 per cent over five years or simple average growth of 10 per cent per annum.

Mr Rather said the GSDP has maintained its growth trend despite sluggish national economy. Over the last year’s figure of Rs 42,878.25 crore (quick estimates), its growth rate was worked out at 5.8 per cent, a slight improvement over last year’s figure of 5.5 per cent as against 4.8 per cent national growth rate.

“As far as the sector wise contribution to the GSDP is concerned, the primary sector is estimated to contribute 21.07 per cent. It growth rate is estimated as 1.44 per cent. Within the primary sector, the growth rate of Agriculture and Animal Husbandry segment is estimated at 1.56 per cent. The secondary or industrial sector is estimated to contribute 22.39 per cent with growth rate of 3.79 per cent while the tertiary or the service sector has maintained prominence with its contribution rising to 56.54 per cent, the growth rate of 8.47 per cent.

Recalling that during his first budget speech of present dispensation in August 2009, he had identified 10 packs of major financial burden, which he got in legacy, Mr Rather identified them as mounting fiscal deficit far in excess of the limits prescribed under J&K FRBM Act, loss of financial benefits under items of Award of 12th Finance Commission, shifting of about Rs 1200 crores revenue expenditure from plan to non-plan, retrospective implementation of recommendations of Sixth Pay Commission involving a big hike in salaries and pension apart from Rs 4300 crores worth arrears and worst economic slowdown at national level, Mr Rather said these were the formidable challenges and slowly he has tried to put the State back on the rails.

Addressing customary press conference after presentation of budget along with Minister of State for Finance Dr Manohar Lal Sharma, Economic Advisor Jalil Khan and Principal Secretary Finance BB Vyas, Mr Rather said he has not imposed new taxes in his last five budgets as he knows the people can’t tolerate the burden of taxes. He said he has only made insignificant increase in the taxes previously.

The Finance Minister claimed that the Planning Commission of India, Finance Commission of India, Union Finance Ministry, Principal Accountant General and Empowered Committee of States’ Finance Ministers of India have hailed the tax performance and reforms of Jammu and Kashmir.

He said the Government has surrendered Rs 750 crores worth taxes by extending incentives to the industry including VAT remissions.

He added that the Government was well within the limits of FRBM Act.

Mr Rather said he still stands by new job policy and new pension scheme to curb non-plan expenditure including salaries and pension bill. He said the pension bill of the State, which was Rs 900 crores in 2004-05 has now reached Rs 3900 crores.

“Under new pension scheme, the new recruits would get pension as per the contributions (10 per cent each by the employee and the Government). Otherwise, a time would have come that the Government would have been left with no money to pay the pensions,” he said. Moreover, he added, the new pension scheme has now been launched all over the country.

He said the new job policy, more jobs have been generated.

On third installment of Sixth Pay Commission to Government employees, Mr Rather said it would be cleared by the end of current financial year.

On recruitment of daily wagers, he added that they would be engaged as per requirement and the set guidelines.

On whether the budget was part of vote bank politics in the election year, Mr Rather replied in negative saying it had been his tradition not to impose new taxes except for marginal changes. He said tax revenue of the State, which was just Rs 2600 crores in 2008-09 would reach Rs 6700 crores this fiscal year and was projected at Rs 7500 crores during 2014-15.

To a question on budgetary provision for new administrative units, Mr Rather said the Government has kept adhoc provision for them and not permanent as the Finance and Planning Departments were working out accurate figures.

“We will give the funds for creation of new units,” he added.

He said an amount of Rs. 3.50 cr has been earmarked for Women Development Corporation to set-up 100 more Self Help Groups (SHG) comprising 44,000 women which is expected to go a long way in upgrading the living standard of women folk.

Mr Rather said that Domel-Katra railway link which shall facilitate the carriage of yatris to Shri Mata Vaishno Devi Ji shrine up to Katra is also likely to be commissioned soon. “The trains full of the devotees from various parts of the country can be expected to directly chug in to Katra in the very near future,” he added.

He said the work on the laying of railway track between Katra and Banihal is progressing satisfactorily. The entire rail link between Kashmir and the rest of the country is scheduled to be completed by the year 2017.

“The Mughal Road linking the two regions of the State through an alternative link between parts of Shopian in Kashmir valley and Poonch in Jammu division has been completed as a fair weather road within the originally prescribed parameters, at an estimated cost of Rs 640 crore. The State Government is now trying to convince the Central Government about the need to fund it further for converting it into an all weather road,” the Finance Minister said.

He added that the work on upgrading of the National Highway 1A is at various stages of implementation. “The Lakhanpur to Nagrota portion is now complete. The portion between Nagrota and Udhampur is expected to be commissioned during the forthcoming summer. A couple of stretches continue to be problematic.”

“In respect of power generation, we have harnessed potential of 2693.45 MW so far through 32 HEPs under Central, State and IPP sectors. The addition made during the last five years comes to 824.26 MW. Out of this, installed capacity of 235.50 MW has been added during the current financial year (2013-14) itself through the commissioning of six HEPs, namely Nimo Bazgo, Chutak, Pahalgam, Uri-II (two units), Tangmarg and Ranjala Dunadi. Twenty HEPs with a total installed capacity of 1785 MW are under execution. Twenty eight HEPs with combined capacity of 2296.50 MW are at various stages of tendering. Four HEPs with combined capacity of 3558 MW are under appraisal of CEA and CWC. Ten HEPs with capacity of 2237 MW are under investigation including some for which DPRs are also under preparation,” Mr Rather said.

He said the work on the execution of 450 MW Baglihar Hydro Electric Project Phase II is at an advance stage. Efforts are on to get it commissioned during the summer of 2015. The 850 MW Ratle HEP in IPP mode and four more other HEPs are slated to be commissioned by the year 2017.

“A positive development has taken place on the thermal power generation side which is essential to meet our winter needs when our hydel generation is at its lowest level. After lot of persuasion and follow up, the Ministry of Coal has agreed to allot a coal block located in the State of Odisha, in the joint name of J&K SPDC and NTPC. A consultant has been accordingly appointed by J&K SPDC to conduct technical studies for exploitation of this coal block for setting up a 660 MW thermal power plant. Simultaneously, the details of a joint sector arrangement are also being negotiated with the NTPC. We can now hope that the work on a much needed thermal project shall commence in near future after completing all the relevant formalities and obtaining all the requisite clearances.”

The Government has already raised the issue of taking back all the old Hydel Projects commissioned by the NHPC, which have already generated enough returns for their owners by now, so that these projects can become a source of strength for the economic base of the State. The Government is firm in its determination to take recourse to all possible means at its disposal to take this exercise to its logical end, the Finance Minister said.

“On the directions of the Government, the State Power Development Corporation is actively engaged in an exercise of quantification of losses incurred by the State in the past, as well as the ongoing and future losses on account of the adverse provisions of the Indus Waters Treaty. The Government intends to take up this issue with the Union Government in a conclusive manner once it is armed with the necessary data,” he added.

The Government has already raised the issue of increasing the free power share of the State Government in all the Hydel Projects executed in the Central Sector from its present level of 12% to at least 30%, through various forums. “We are supported in our demand by other Himalayan States as well,” Mr Rather said.

“We shall be taking up all these issues forcefully, with the 14th Finance Commission as well, before and during their expected visit to the State during the next summer,” he added.

He said the Government has been pursuing its case to secure its rights in the Thein Dam Project, which have been persistently denied by the Punjab Government. In the meanwhile, the Government engaged a Consultant to suggest an alternative way of tapping our waters from the upper reaches of the Thein Dam.

“The Consultant prepared a DPR and based on that, the Government has accorded approval to the execution of a Rs 275 crore irrigation project to carry waters up to Basant Pur. The Department has floated tenders for the ‘intake structure’ and has simultaneously initiated action for obtaining the environment clearance for execution of the Project.”