Mumbai, May 31: The rupee pared its early gains to settle lower by 13 paise at 83.42 against the US dollar on Friday amid volatile domestic equity markets and month-end dollar demand.

Forex traders said increased month-end demand for the greenback from oil marketing companies weighed on the Indian currency even as it found some support due to losses in crude oil prices.

Foreign investors were net buyers of Indian equities on Friday as they purchased shares worth Rs 1,613.24 crore on a net basis. FIIs bought shares worth Rs 95,467.56 crore and sold equities worth Rs 93,854.32 crore in one of the record foreign investor activities in the cash segment.

At the interbank foreign exchange market, the local unit opened at 83.25 and oscillated between the intra-day high of 83.23 and lowest level of 83.49 during the session. It finally settled at 83.42, registering a loss of 13 paise from its previous closing level.

On Thursday, the rupee gained 11 paise to close at 83.29 against the US dollar.

Anuj Choudhary Research Analyst, Sharekhan by BNP Paribas, said the rupee depreciated on month-end dollar demand from oil marketing companies and importers.

“We expect rupee to trade with a slight negative bias on overall strength in the US dollar amid safe haven demand on the back of geopolitical tensions in the Middle East.

“Volatility in the domestic markets amid uncertainty over election results may also put downside pressure on the rupee. However, positive tone in global markets today may support the rupee at lower levels,” Choudhary said.

Traders are expected to take cues from the upcoming domestic GDP data and fiscal deficit numbers and personal consumption expenditure price index from the US.

“USD-INR spot price is expected to trade in a range of Rs 83.10 to Rs 83.70,” Choudhary said.

Jateen Trivedi, VP Research Analyst – Commodity and Currency, LKP Securities, said the rupee traded weak ahead of the outcome of the ongoing general elections.

“…the rupee’s volatility has remained range-bound and stable due to the RBI’s efforts. The absence of speculation has kept the rupee trading within a broad range of 83.00-83.55,” he said.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.02 per cent lower at 104.64.

According to analysts, US dollar declined after the latest US GDP data released on Thursday showed the world’s largest economy grew at a slower pace of 1.3 per cent against the projected 1.6 per cent in the January-March quarter. This triggered expectations of interest rate reduction by the Federal Reserve.

Brent crude futures, the global oil benchmark, fell 0.44 per cent to USD 81.50 per barrel.

India’s economy grew by 8.2 per cent in the fiscal year that ended in March, cementing the country’s position as the fastest-growing major economy in the world.

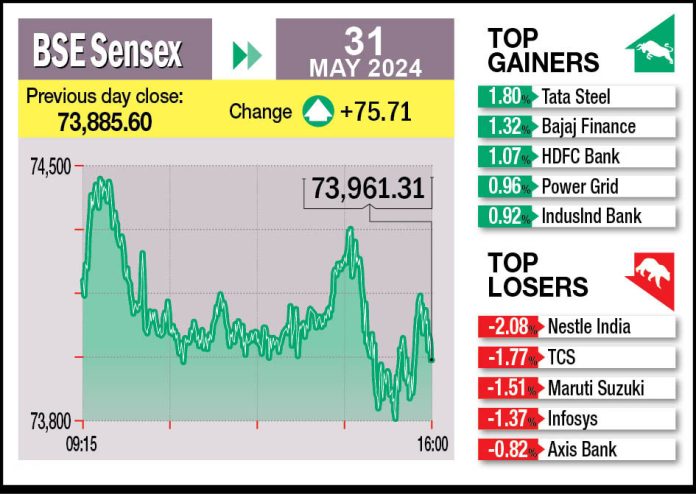

On the domestic equity market, the 30-share BSE Sensex rose 75.71 points, or 0.10 per cent, to close at 73,961.31 points. The broader NSE Nifty went up 42.05 points, or 0.19 per cent, to close at 22,530.70 points. (PTI)