- RBI projects 7.8 pc GDP growth for 2022-23

- RBI retained its growth projection at 9.2% and inflation at 5.3% for the current financial year

MUMBAI, Feb 10: Reserve Bank of India (RBI) on February 10 kept the benchmark interest rate unchanged at 4% and decided to continue with its accommodative stance in the backdrop of an elevated level of inflation.

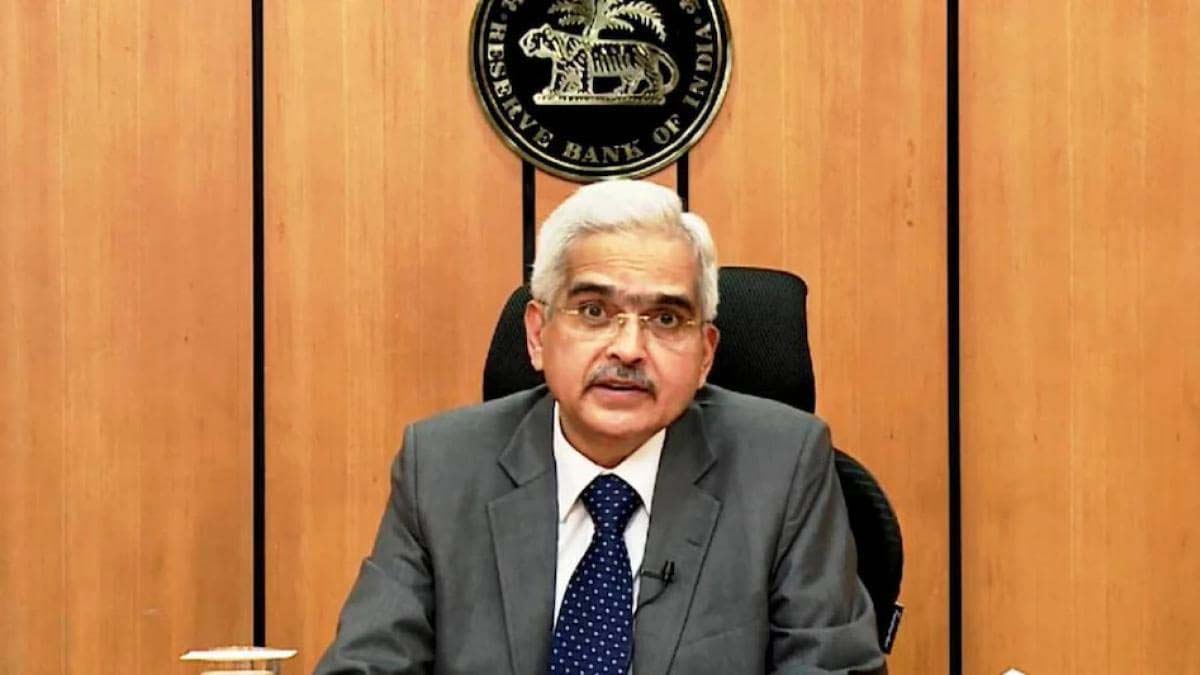

This is the tenth time in a row that the Monetary Policy Committee (MPC) headed by RBI Governor Shaktikanta Das has maintained the status quo. RBI had last revised its policy repo rate or the short-term lending rate on May 22, 2020 in an off-policy cycle to perk up demand by cutting the interest rate to a historic low.

This is the first MPC meeting after presentation of Budget 2022-23 in Parliament on February 1.

MPC has decided to keep benchmark repurchase (repo) rate at 4%, Mr. Das said while announcing the bi-monthly monetary policy review.

Consequently, the reverse repo rate will continue to earn 3.35% interest for banks for their deposits kept with RBI.

Mr. Das said MPC voted unanimously for keeping interest rate unchanged and decided to continue with its accommodative stance as long as necessary to support growth and keep inflation within the target.

RBI retained its growth projection at 9.2% and inflation at 5.3% for the current financial year.

Retail inflation rose to a five-month high of 5.59% in December from 4.91% in November, mainly due to an uptick in food prices.

MPC has been given the mandate to maintain annual inflation at 4% until March 31, 2026, with an upper tolerance of 6% and a lower tolerance of 2%.

The bi-monthly policy comes against the backdrop of the Budget wherein a nominal gross GDP of 11.1% has been estimated for 2022-23.

The government expects this growth to be fuelled by a massive capital spending programme outlined in the Budget with a view to crowd-in private investment by reinvigorating economic activities and creating demand.

Finance Minister Nirmala Sitharaman raised capital expenditure (capex) by 35.4% for the financial year 2022-23 to ₹7.5 lakh crore to continue the public investment-led recovery of the pandemic-battered economy. The capex in the current financial year is pegged at ₹5.5 lakh crore.

The spending on building multimodal logistics parks, metro systems, highways, and trains is expected to create demand for the private sector as all the projects are to be implemented through contractors.

With regard to borrowing, the government plans to borrow a record ₹11.6 lakh crore from the market in 2022-23 to meet its expenditure requirement to prop up the economy. This is nearly ₹2 lakh crore higher than the current year’s Budget estimate of ₹9.7 lakh crore.

Even the gross borrowing for the next financial year will be the highest-ever at ₹14,95,000 crore as against ₹12,05,500 crore in the Budget Estimate (BE) for 2021-22.

Fiscal deficit — the excess of government expenditure over its revenues — is estimated to come down to 6.4% of GDP next year as against 6.9% pegged for the current fiscal ending March 31.

Meanwhile The Reserve Bank on Thursday pegged the economic growth rate for 2022-23 at 7.8 per cent, down from 9.2 per cent expected in 2021-22, in view of uncertainties on account of the pandemic and elevated global commodity prices.

The Reserve Bank’s growth projection for next financial year is lower than 8-8.5 per cent projected by the Finance Ministry in the recent Economic Survey which was tabled in Parliament earlier in the month.

Unveiling the bi-monthly policy, RBI Governor Shaktikanta Das said, “recovery in domestic economic activity is yet to be broad-based, as private consumption and contact-intensive services remain below pre-pandemic levels.”

He observed that the announcements in the Union Budget 2022-23 on boosting public infrastructure through enhanced capital expenditure are expected to augment growth and crowd in private investment through large multiplier effects.

“Global financial market volatility, elevated international commodity prices, especially crude oil, and continuing global supply-side disruptions pose downside risks to the outlook,” he added.

Overall, he said, there is some loss of the momentum of near-term growth while global factors are turning adverse.

“Looking ahead, domestic growth drivers are gradually improving. Considering all these factors, real GDP growth is projected at 7.8 per cent for 2022-23 with Q1:2022-23 at 17.2 per cent; Q2 at 7.0 per cent; Q3 at 4.3 per cent; and Q4 at 4.5 per cent,” he said.

The first advance estimates of national income released by the National Statistical Office (NSO) on January 7, 2022 placed India’s real gross domestic product (GDP) growth at 9.2 per cent for 2021-22, surpassing its pre-pandemic (2019-20) level.

“All major components of GDP exceeded their 2019-20 levels, barring private consumption. In its January 31 release, the NSO revised real GDP growth for 2020-21 to (-) 6.6 per cent from the provisional estimates of (-) 7.3 per cent,” he said.

Available high frequency indicators suggest some weakening of demand in January 2022 reflecting the drag on contact-intensive services from the fast spread of the Omicron variant of coronavirus in the country, he said.

Rural demand indicators two-wheeler and tractor sales contracted in December-January, he said, adding, area sown under Rabi crops up to February 4, 2022 was higher by 1.5 per cent over the previous year.

Amongst the urban demand indicators, he said, consumer durables and passenger vehicle sales contracted in November-December on account of supply constraints while domestic air traffic weakened in January under the impact of Omicron.

Investment activity displayed a mixed picture while import of capital goods increased in December, production of capital goods declined on a year-on-year (y-o-y) basis in November.

Merchandise exports remained buoyant for the 11th successive month in January 2022; non-oil, non-gold imports also continued to expand on the back of domestic demand.

The bi-monthly policy comes against the backdrop of the Budget presented earlier this month estimating a nominal GDP of 11.1 per cent for 2022-23. The Economic Survey pegs economic growth at 8-8.5 per cent for next financial year.

The government expects this growth to be fuelled by a massive capital spending programme outlined in the Budget with a view to making crowd in private investment by reinvigorating economic activities and creating demand.

Finance Minister Nirmala Sitharaman raised capital expenditure (capex) by 35.4 per cent for 2022-23 to Rs 7.5 lakh crore to continue the public investment-led recovery of the pandemic-battered economy. The capex this year is pegged at Rs 5.5 lakh crore.

The spending on building multimodal logistics parks, metro systems, highways, and trains is expected to create demand for the private sector as all the projects are to be implemented through contractors.

With regard to borrowing, the government plans to borrow a record Rs 11.6 lakh crore from the market in 2022-23 to meet its expenditure requirement to prop up the economy. This is nearly Rs 2 lakh crore higher than the current year’s Budget estimate of Rs 9.7 lakh crore.

Even the gross borrowing for the next financial year will be the highest-ever at Rs 14,95,000 crore as against Rs 12,05,500 crore Budget Estimate (BE) for 2021-22.

Fiscal deficit — the excess of government expenditure over its revenues — is estimated to come down to 6.4 per cent of GDP next year as against 6.9 per cent pegged for the current fiscal year ending March 31. (Agencies)

RBI’s monetary policy highlights

Following are the highlights of the RBI’s monetary policy statement 2021-22.

* Benchmark lending rate kept unchanged 10th time in a row at 4 pc, reverse repo rate at 3.35 pc

* Projects GDP growth at 7.8 pc for next fiscal, against 9.2 pc this fiscal

* India charting different course of recovery than rest of the world; to be fastest growing economy

* RBI to continue with accommodative stance to revive and sustain growth; pandemic hold global economy hostage

* Retail inflation projected at 5.3 pc for current fiscal, 4.5 pc in FY23

* Inflation to peak in the current quarter within tolerance band, moderating in the second half of next fiscal

* Hardening global crude oil prices present upside risk to inflation

* Indian rupee showed resilience in the face of global spillovers

* Current account deficit to be below 2 pc of GDP in current fiscal

* Overall system liquidity remains in large surplus

* RBI would continue to insulate domestic economy from global spillovers

* RBI extends by 3 months on-tap liquidity facility of Rs 50,000 crore for healthcare, contact intensive sector

* E RUPI digital voucher cap raised from Rs 10,000 to Rs 1 lakh and multiple-use permitted

* Next meeting of the Monetary Policy Committee (MPC) is scheduled during April 6-8. (Agencies)