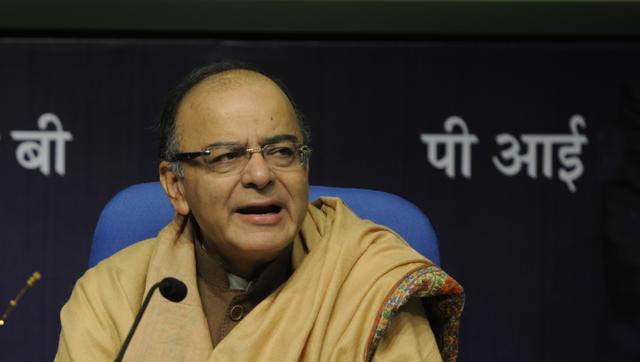

NEW DELHI, Jan 2: After hitting the Congress wall in two successive Parliament sessions, Finance Minister Arun Jaitley today exuded confidence that landmark GST Bill will be passed in the next session as numbers in the Rajya Sabha will tilt in favour of the new indirect tax regime.

“The next session is going to be extremely important. And half way through the next session, the numbers of the Upper House are also going to change. So I am reasonably optimistic, as far as the next session is concerned, that we may be able to push it through,” Jaitley said.

Parliament’s Budget session will start in last week of February.

Addressing the officer trainees of the Indian Revenue Service, he said there is virtually a consensus for GST among political parties and “everybody supports it”.

“…Parliamentary obstructionism has prevented it from happening in the last two sessions”.

The Goods and Services Tax (GST) that will subsume all indirect taxes like excise duty, service tax and sales tax into one uniform rate, is stuck in Rajya Sabha where main opposition Congress wants three changes.

Congress stalled the passage of the Constitution Amendment Bill in last two sessions, derailing government’s plan to roll out GST from April 1, 2016.

Jaitley said the concept of GST was first conceived in 2006 and the Constitution Amendment Bill was first introduced in 2011, but the UPA government could not build a consensus with the states.

“The GST is already delayed. Ideally it should have come much earlier,” he said, adding that the tax regime will render India into one big market, make tax evasion difficult, ensure seamless movement of goods and services and push up GDP.

Jaitley said the NDA Government after coming to power built broad consensus among the states and following that brought the Constitution Amendment Bill again in Parliament.

“I continue to discuss with the states and with all political groups, so that we can ensure its safe passage in the Upper House,” he said.

The idea of GST was born in the earlier part of the last decade, he said. “Though people have been discussing this since the 1990s, radical idea of this kind takes time before a consensus can develop”.

He said after the Constitution Amendment Bill is passed in Parliament, there are three more legislations – Central GST (CGST), State GST (SGST) and Integrated GST (IGST) – which are required to be passed.

“And those have been worked out. We are in the stage of readiness as far as those legislations are concerned which will have to be passed then by the Central Government and by the State governments,” he said. (PTI)