* Defence budget up by 6.2 pc

* Will fulfill dreams of all: PM

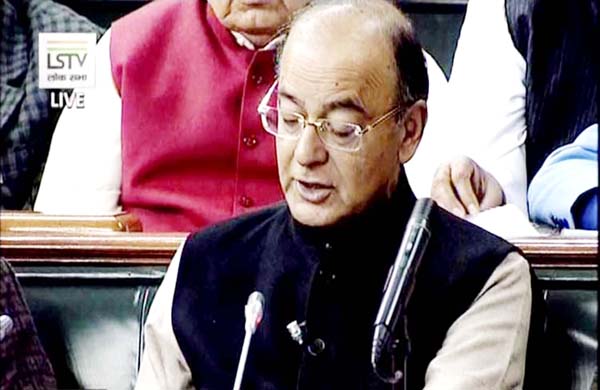

New Delhi, Feb 1: In a pre-poll Budget aimed at softening the demonetisation blow, Finance Minister Arun Jaitley today halved the basic income tax rate to 5 per cent and lowered rate for small companies while boosting spending on rural employment, agriculture and infrastructure.

Creating history, the Minister presented a merged railway and general Budget after advancing the dates by a month that provides a record outlay of Rs 3,96,135 crore for infrastructure schemes besides a capital expenditure of Rs 1.3 lakh crore on railways and Rs 64,000 crore on highways.

The Budget seeks to provide a record Rs 10 lakh crore in loans to farmers, boost funds for rural employment guarantee programme, bring one crore households out of poverty and promised to build one crore houses by 2019 for the homeless ahead of the crucial elections in five states including Uttar Pradesh and Punjab.

In view of the fact that the proposed GST is expected to be rolled out soon, he left indirect taxes largely untouched except for some changes in duties on tobacco products, solar panels and circuit for mobile phones.

While excise duty on pan masala has been hiked to 9 per cent from 6 per cent currently and that on unmanufactured tobacco to 8.3 per cent from 4.2 per cent, the same on filter and non-filter cigarettes of all length was also hiked.

Mobile phones will be costlier with the Budget proposing a 2 per cent special auxiliary duty on import of populated printed circuit boards (PCBs).

While the income tax rate for income between Rs 2.5 lakh and Rs 5 lakh has been lowered to 5 per cent, a 10 per cent surcharge has been slapped on income between Rs 50 lakh and Rs 1 crore. The 15 per cent surcharge on income above Rs 1 crore will continue.

While the surcharge alone would net Rs 2,700 crore a year, his give away on direct tax proposals will result in a loss of Rs 15,500 crore.

The change in the personal income tax rate for individual assessees would reduce the tax liability of all persons below Rs 5 lakh to either to zero (with rebate) or 50 per cent of their existing liability.

In order not to have duplication of benefit, the existing benefit of rebate available to them is being reduced to Rs 2,500 available only to assessees up to income of Rs 3.5 lakh.

While the taxation liability of people with income up to Rs 5 lakh is being reduced to half, all other categories of tax payers in the subsequent slabs will also get a uniform benefit of Rs 12,500 per person.

In the case of senior citizens above 60 years, there will be no tax up to Rs 3 lakh, while the exemption will be up to Rs 5 lakh in case of citizens above 80 years. Both the categories will attract income tax of 20 per cent on income between Rs 5 lakh and Rs 10 lakh and 30 per cent for income above Rs 10 lakh.

Against the backdrop of demonetisation intended to eliminate black money and introduce clean transactions, the Budget barred any transaction in cash above Rs 3 lakh. As a measure of transparency in political funding, he lowered to one-tenth the donation that political parties can accept in cash to Rs 2,000 per donor.

Also bearer Electoral Bonds will be introduced which a donor can buy from a scheduled bank through cheque or e-mode, for making donations.

The Finance Minister expressed confidence that the pace of remonetisation has picked up and would soon reach comfortable levels with effects not expected to spillover into the next fiscal.

Devoting considerable attention to demonetisation and its aftereffects, Jaitley said the surplus liquidity in the banking system created by the note ban decision will lower borrowing cost and increase access to credit.

“This will boost economic activity with multiplier effect,” he said in his nearly two hour long Budget speech.

Quoting from preliminary data, the Minister said during the 50-day window provided to deposit the junked notes, deposits between Rs 2 lakh and Rs 80 lakh were made in about 1.09 crore accounts with an average deposit size of Rs 5.03 lakh.

Deposits of more than 80 lakh were made in 1.48 lakh accounts with average deposit size of Rs 3.31 crores. “This data mining will help us immensely in expanding the tax net as well as increasing the revenues, which was one of the objectives of demonetisation,” he said.

The Finance Minister ruled out abolition of Minimum Alternate Tax (MAT) on companies but allowed larger period of 15 years instead of 10 years for setting of MAT payments.

He lowered the corporate tax on companies with turnover of less than Rs 50 crore to 25 per cent from 30 per cent, a move that will benefit 6.67 lakh firms out of 6.94 lakh companies that file returns.

This would lead to a revenue loss of Rs 7,200 crore per annum to the Government.

Budget put the fiscal deficit at 3.2 per cent of GDP in 2017-18, smaller than the current year’s 3.5 per cent but wider than the previous target of 3 per cent. It will shrink to 3 per cent in the year through March 2019 instead of 2018.

The Budget accorded low-cost housing infrastructure status, gave tax relief for overseas investors in some bonds and scrapped Foreign Investment Promotion Board (FIPB) to make it easier for doing business in India.

Besides, Rs 10,000 crore will be injected into state- owned banks as capital in the coming fiscal as compared to Rs 25,000 crore budgeted for the current year.

The Budget proposal to reduce tax rate to 5 per cent from 10 per cent for people with income in the slab of Rs 2.5 lakh to Rs 5 lakh will reduce their tax liability to half while all other tax payers above this slab will also be benefited in terms of lesser tax of Rs 12,500 per individual. This would result in a revenue loss of Rs 15,500 crore to the government.

The levy of surcharge of 10 per cent on individuals with income between Rs 50 lakhs to Rs 1 crore would lead to a revenue gain of Rs 2,700 crore.

In order to ensure timely filing of returns and expeditious issue of refund, a fee will be levied for delay in filing of return.

Continuing with Government steps to clamp down on black money, Jaitley proposed to ban all cash transactions above Rs 3 lakh beginning April 1, 2017.

The decision to ban cash transactions beyond a threshold is based on the recommendation of the Special Investigation Team on black money that was set up by the Supreme Court, Jaitley said while presenting Union Budget 2017-18 in Parliament.

All cash transactions above Rs 3 lakh will be banned, he said.

The SIT, headed by Justice M B Shah (retired), in July had submitted its fifth report to the Supreme Court on steps needed to curb black money.

Noting that a large amount of unaccounted wealth is stored in cash, SIT had said: “Having considered the provisions which exist in this regard in various countries and also having considered various reports and observations of courts regarding cash transactions, the SIT felt that there is a need to put an upper limit to cash transactions.”

It recommended a total ban on cash transactions of Rs 3 lakh and above and that “an Act be framed to declare such transactions as illegal and punishable under law”.

Under repeated opposition attack for alleged neglect of minorities, the Modi Government has increased the Minority Affairs Ministry’s budget for the next fiscal by nearly 10 percent to Rs 4195.48 crore from Rs 3827.25 crore during the current financial year.

Of this, Rs 2053.54 crore has been earmarked for educational empowerment of minorities, while Rs 1200 crore and Rs 634.95 crore has been kept aside for implementation of multi-sectoral development programme and skill development initiatives respectively.

Commenting on the increase of Rs 368.23 crore in budgetary allocation for the minorities, Minority Affairs Minister Mukhtar Abbas Naqvi said it was after many years that the budget of the ministry has been increased “significantly”.

“After many years, the Minority Affairs Ministry’s budget has been increased by more than Rs 368 crore. It is Rs 4195.48 crore for 2017-18 from Rs 3827.25 in 2016-17. This significant increase in budget will help in empowerment of minorities. Thanks to Prime Minister Narendra Modi and Jaitley,” Naqvi said.

In a major move aimed at promoting transparency in political funding, Finance Minister Arun Jaitley today announced capping of anonymous cash donations to political parties at Rs 2,000 and introduced electoral bonds.

The bonds, which will not carry the name of the donor, can be purchased from authorised banks against cheque or e- payment. Such securities can be redeemed only through registered accounts of a political party.

“Objective of this year’s Budget is that the pace of economic growth should be significantly pushed, political and economic system is cleansed, and honest taxpayers are incentivised and those who don’t pay tax even after income should be brought under tax net,” Jaitley said.

Towards this objective, the Budget limits donations to political parties from a single anonymous source to 10 per cent of the current Rs 20,000 cap. This in line with a recommendation by the Election Commission.

Political parties will be entitled to receive donations by cheque or digital mode from their donors.

“The system involves the following steps – the donor and the donee will get a tax exemption. A donor will get a deduction, donee as a political party will get an exemption provided the returns are filed by the political party” and donations by any single donor above Rs 2000 are in form of cheque or digital mode, he said.

Also, an additional amendment has been proposed to the Reserve Bank of India Act to enable issuance of electoral bonds.

“A notified bank will be issuing bonds and any donor can buy those bonds from cheque or by digital payment. So it is white, clean money, tax-paid money,” he said. “Those bonds by the donor can be given to the political parties. They will be redeemable within short period of time.”

The overall defence budget today saw an increase of a marginal 6.2 per cent for the next fiscal at Rs 2.74 lakh crore from the current Rs 2.58 lakh crore, with the capital outlay to cover the modernisation programmes getting a hike of 10.05 per cent.

The defence outlay amounted to 12.77 per cent of the total budget.

The capital outlay for the three defence services for the purchase of new equipment, weapons, aircraft, warships and other military vehicles stood at Rs 86,488 crore for 2016-17 as compared to Rs 78,586 crore for this fiscal.

Budget documents show that revised capital budget for this fiscal is Rs 71,700 crores, but it is not clear whether the Defence Ministry was unable to spend the remaining amount (Rs 6,886 crore) or whether any savings were done.

The money allocated for defence pensions was Rs 85,737 crore as compared to revised estimate of Rs 85,624 crore this fiscal.

“Rs 2,74,114 crore is allocated for defence expenditure, excluding pension. This includes Rs 86,000 crores for defence capital,” Jaitley said.

The Government today allocated Rs 1,840.77 crore to the Tourism Ministry in the budget for the next fiscal, including Rs 959.91 crore for the Integrated Development of Tourist Circuits around specific themes (Swadesh Darshan scheme).

The Ministry would be receiving a little over Rs 250 crore more in the 2017-18 fiscal as compared to the ongoing financial year for which it was allocated Rs 1,590.32 crore, according to the budget document.

Besides, another Rs 100 crore have been allocated for Pilgrimage Rejuvenation and Spiritual Augmentation Drive (PRASAD).

Significantly, as much as Rs 412 crore have been provided for promotion and publicity of tourism ministry’s various programmes and scemes in the Union Budget presented by Finance Minister Arun Jaitley today.

Under Swadesh Darshan, 13 thematic circuits have been identified for development, namely North-East India Circuit, Buddhist Circuit, Himalayan Circuit, Coastal Circuit, Krishna Circuit, Desert Circuit, Tribal Circuit, Eco Circuit, Wildlife Circuit, Rural Circuit, Spiritual Circuit, Ramayana Circuit and Heritage Circuit.

On the other hand, as many as 13 cities– namely Ajmer, Amritsar, Amravati, Dwarka, Gaya, Kamakhaya, Kanchipuram, Kedarnath, Mathura, Patna, Puri, Varanasi and Velankanni — have been identified for development under Pilgrimage Rejuvenation and Spirituality Augmentation Drive (PRASAD) by the Ministry of Tourism.

Smokers and tobacco consumers will have to pay more for their indulgence as Finance Minister Arun Jaitley continued with the crackdown on cigarettes, bidis and tobacco products by increasing taxes in the Budget 2017-18.

Besides, mobile phones and LED lights assembled in India will also become dearer with the finance minister increasing duties on imported printed circuit boards and components respectively.

Jaitley, however, made an attempt to make it more affordable for clean energy sources by cutting duties on solar tempered glass, fuel cell based power generating systems and wind operated energy generator.

With the expected implementation of GST, large scale tinkering of tax structure has been avoided in the Budget thereby sparing most of the commonly used daily items from price changes.

“Implementation of GST is likely to bring more taxes to both central and state governments because of widening of tax net. I have preferred not to make many changes in current regime of Excise and Service Tax because the same are to be replaced by GST soon,” Jaitley said while presenting the Budget.

Yet, tobacco and cigarettes have not been spared.

Excise duty on unmanufactured tobacco has been almost doubled to 8.3 per cent from 4.2 per cent earlier, while that on pan masala has been hiked to 9 per cent from 6 per cent.

Likewise, excise duty on cigar, cheroots has been changed to 12.5 per cent or Rs 4,006 per thousand, whichever is higher from 12.5 per cent or Rs 3,755 per thousand, whichever is higher. Excise duty on chewing tobacco, including filter khaini and jarda scented tobacco has also been doubled to 12 per cent from 6 per cent earlier.

Excise on paper-rolled handmade bidis has been increased to Rs 28 per thousand from from Rs 21 per thousand and the same for paper rolled biris has gone up from Rs 21 per thousand to Rs 78 per thousand.

Populated Printed Circuit Boards (PCBs) for use in the manufacturing of mobile phones, subject to actual user condition will also attract SAD of 2 per cent from nil earlier.

Similarly, parts used for manufacturing of LED lights will attract basic customs duty 5 per cent and CVD of 6 per cent from nil earlier.

As per the Budget announcement, imported cashew nut (roasted, salted or roasted and salted) will also become dearer as basic customs duty on the item has been hiked to 45 per cent from 30 per cent earlier.

Imported silver medallion, silver coins, having silver content not below 99.9 per cent, semi-manufactured form of silver and articles of silver will also be dearer as there items will now attract CVD of 12.5 per cent from nil earlier.

Jaitley has made a few announcements in the Budget that will help consumers.

Railway travel with e-tickets booked through IRCTC will become cheaper as service charge on it has been withdrawn.

RO water purifiers are likely to be slightly cheaper with basic customs duty on imported membrane sheet and tricot/ spacer for use in the manufacture of RO membrane element for household filters has been reduced from 12.5 per cent to 6 per cent.

However, with a view to encourage domestic production of RO membrane element, the government has hiked basic customs duty on it to 10 per cent from 7.5 per cent earlier.

Customs duty of LNG has been halved to 2.5 per cent which can lead to lower power and fertiliser costs.

With an eye on promoting clean energy source, the government has reduced basic customs duty on solar tempered glass used in solar panels from 5 per cent to nil.

Likewise, the basic customs duty and CVD on all items of machinery required for fuel cell based power generating systems to be set up in the country lowered to 5 and 6 per cent from 10/7 and 12.5 per cent earlier.

Also, the basic customs duty, on resins and catalyst for manufacture of cast components for wind operated energy generator has been lowered to 5 per cent from 7.5 per cent earlier, while CVD and SAD on these items have been slashed to nil from 12.5 per cent and 4 per cent, respectively earlier.

Continuing the focus on promoting leather industry, Jaitley announced that basic customs duty on vegetable tanning extracts used in making leather products such as bags and shoes has been slashed to 2.5 per cent from 7.5 per cent earlier.

Miniaturised POS card reader for m-POS, micro ATM as per standard version, finger print reader/scanner and iris scanner will also be cheaper as duty on these item have been reduced to nil.

For the defence forces, services provided or agreed to be provided by the Army, Naval and Air Force Group Insurance Funds by way of life insurance to their members under the Group Insurance Schemes of the Central Government is being exempted from service tax as against 14 per cent charged earlier.

Income Tax officers can now inspect and scrutinise the books of accounts of charitable institutions with Jaitley proposing to expand the scope of ‘Survey’ under I-T Act to include such entities.

Under the existing norms relating to survey, tax officials can enter any place, where business or profession is carried on, or at which any books of account or other documents or any part of cash or stock or other valuable article or thing relating to the business or profession are kept.

“It is proposed to widen the scope of Section 133 by amending sub-section (1) to include any place, at which an activity for charitable purpose is carried on. This amendment will take effect from April 1, 2017,” said the memorandum to Finance Bill 2017.

Under the survey action, tax sleuths can visit business premises of the trader/operator and make analysis of the available stock and record it, whereas under search operations, both residential and business premises are visited by the taxman.

Terming roads, railways and rivers as the “lifeline of our country”, Jaitley today enhanced the allocation for highways sector by 12 per cent to Rs 64,900 crore for 2017-18.

Highways sector, which has been one of the priority areas of the government, had a budgetary estimate of Rs 57,976 crore for this fiscal, which was revised to Rs 52,447 crore.

“In the road sector, I have stepped up the Budget allocation for highways from Rs 57,976 crore in BE (budgetary estimate) 2016-17 to Rs 64,900 crore in 2017-18,” Jaitley said while tabling the Budget.

“Railways, roads and rivers are the lifeline of our country,” he said.

With railways plagued by repeated derailments, Government today proposed setting up of a special safety fund of Rs 1 lakh crore that will cover upgradation of tracks and signalling besides elimination of unmanned level crossings.

The Railway Budget, merged with General Budget 2017-18, also provides for commissioning of new railway lines of 3,500 km will against 2,800 kms in 2016-17.

Jaitley announced the Plan size for the next fiscal for the Railways at Rs 1,31,000 crore as against Rs 1.21 lakh crore last year.

He proposed creation of ‘Rashtriya Rail Sanraksha Kosh’ (National Rail Safety Fund) with a corpus of Rs 1 lakh crore.

Emphasising on safety, the Budget proposed elimination of all unmanned level crossings on the broad gauge network by 2020.

Addressing concerns of the differently-abled persons, Jaitley announced that 500 stations would be made disbaled friendly.

The Budget also promised to equip all coaches with bio toilets and announced “Clean my coach’ App for passengers.

In order to encourage E-ticketing, Jaitley announced withdrawal of service charges from tickets booked through IRCTC.

Railway PSUs IRCTC, IRFC and Concor are to be listed on various stock exchanges.

The Budget presents the “future”, Prime Minister Narendra Modi said today, while asserting that it is an important step towards overall development of the nation with focus on fulfilling the “dreams” of every section, including the poor, the farmers and the under-privileged.

He said the Budget will create new employment opportunities, help in overall economic growth and help in raising the income of the farmers.

Modi, whose Government presented the third Budget, said it is a reflection of the development measures undertaken over the past two-and-a-half years and the vision to carry forward the momentum in this direction.

“In a way, it is a reflection of our ongoing efforts to see to it that the speed with which our country is changing, gathers momentum,” the Prime Minister said, while describing it as an “excellent” and a “historic” Budget.

“It is my belief that the Budget will carry forward the development agenda of the government, generate a new climate of confidence and help the nation to scale new heights,” he said.

Contending that this Budget was “associated with our aspirations, our dreams and in a way depicts our future”, he said, “This is the future of our new generation, the future of our farmers.”

Explaining about the “future”, he said it has a meaning in each of its letters.

“In FUTURE, the letter ‘F’ stands for the farmer, ‘U’ stands for underprivileged which includes dalit, oppressed, women etc., ‘T’ stands for transparency, technology upgradation – the dream of a modern India, ‘U’ stands for urban rejuvenation – the urban development, ‘R’ stands for rural development and ‘E’ stands for employment for youth, entrepreneurship, enhancement to give a push to new employment and boost to young entrepreneurs,” Modi said.

Underlining that the Budget will empower the poor and live up to the expectations of all, he said “It will provide an impetus to infrastructure, strength to the financial system and a big boost to the development.”

Modi said the budget has provisions to “fulfill the expectations of everyone – from construction of highways to expansion of I-ways, from the cost of pulses to the data speed, from the modernization of railways to simple economic constructions, from education to health, from entrepreneurs to industry, from textile manufacturers to tax deduction.”

The Prime Minister said the merger of the Railway Budget with the general Budget is a major step, which will help in integrated planning of the transport sector.

Railways, he said, can now contribute in a much better way in meeting the transport needs of the country.(PTI)