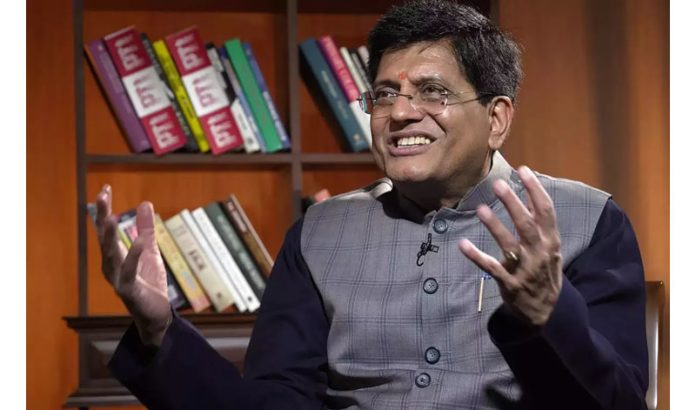

NEW DELHI, Mar 11 : Many developed and developing countries

including Bangladesh, Sri Lanka, and nations of the Gulf region are

keen to start trade in rupee with India as it would help cut transaction

costs for businesses, Commerce and Industry Minister Piyush Goyal has said.

He expressed confidence that the development is going to be a

“very game-changing” dimension to India’s international trade.

“Bangladesh, Sri Lanka are already talking to us and they want

us to start this immediately. Other countries in the Gulf region

are looking at that. I think it’ll take some time for people to see

the benefits. And then we’ll have more and more developed countries

and countries in the Far East also joining the bandwagon. Singapore

is already on board to some extent,” he said.

The minister added that gradually countries are realising that

undertaking trade in domestic currencies has several advantages.

The minister said that it is now picking up traction and a lot

of countries have come forward for this arrangement and are talking

to India for that as they would also like to initiate direct transactions

between their local currency and the rupee.

“Gradually the conscience is setting in that rather than converting

all the transactions into a third currency, both ways, adds significantly

to transaction costs,” Goyal told PTI in an interview.

Undertaking trade in other currencies leads to foreign exchange

and transaction losses as there is a cost for conversion. The delays

in the movement of money also pushed transactors’ costs.

“We started with the UAE. The UAE was one of the first countries

to accept this. It’s now picking up traction. We get a lot of countries

who come and talk to us that they would like to also initiate direct

transactions between the local currency and the rupee.

“It’s a process which takes time. It involves the central bankers

of both nations to create the framework and then it evolves acceptance

by importers and exporters,” Goyal said, adding “when it will take

off, it’ll just fly”.

The engagement is also beneficial as the Indian Rupee is mostly

stable against most of the international currencies and according

to experts, this is one of the reasons that different nations today

want to have trade relations built on rupee trade.

The rupee trade is also helping many of the countries, which have

dollar shortages.

India has started trade in the rupee with neighbouring countries,

including Nepal and Bhutan. The rupee trade mechanism has been initiated

to facilitate trade in national currency with Russia, while Sri Lanka

has included the rupee in its list of designated foreign currencies.

India’s first-ever payment in rupees for crude oil purchased was

from the UAE and that is helping the world’s third largest energy

consumer to push for taking the local currency global, as it looks

for similar deals with other suppliers.

Changes have been made in the FTP (Foreign Trade Policy) to allow

international trade settlement in Indian Rupee with a view to making

INR a global currency.

In July 2022, the Reserve Bank of India (RBI) decided to allow

the settlement of India’s international trade in rupee. Accordingly,

authorised Indian banks are permitted to open and maintain special

rupee Vostro accounts of the partner trading country’s banks.

These accounts keep the foreign bank’s holdings in the Indian counterpart

in rupees. When an Indian trader wants to make a payment to a foreign

trader in rupees, the amount will be credited to this Vostro account.

Similarly, in the reverse scenario, the amount to be paid to an

Indian trader is deducted from the Vostro account, and credited to

the person’s regular account.

Several banks, including HDFC Bank and UCO Bank, have opened special

Vostro accounts to facilitate overseas trade in the rupee and many

countries have expressed interest to have this arrangement for the

local currency trade. (PTI )