Excelsior Correspondent

JAMMU, Sept 11: The Reserve Bank of India has been actively associating itself with the nation-wide intensive campaign launched by Department of Financial Services (DFS), Ministry of Finance, Government of India (GoI), covering all Gram Panchayats (GPs) across all districts of the country, with the objective to achieve, inter alia,saturation of beneficiaries under the FI schemes of GoI and re-KYC of eligible accounts.

Accordingly, saturation camps are being organized in all gram panchayats of the UT of J&K (i.e. 4291 GPs) through nodal bank branches and with active involvement of all other stakeholders, viz., bank branches having presence in the concerned gram panchayat, Business Correspondents (BCs)/CSPs of the concerned banks, public representatives, government functionaries, LDMs etc.

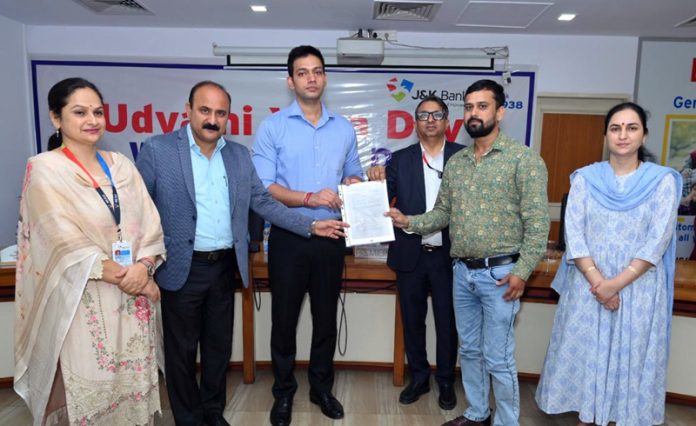

In line with the directions, State Bank Of India organized a saturation camp at Gram Panchayat Gandharwan , Tehsil Akhnoor, through its Branch Akhnoor. The event was graced by Vibha Gupta, Deputy General Manager, RBI , as Chief Guest. Other notable dignitaries included Ram Swaroop DGM RBI; Jayant Mani DGM State Bank Of India Jammu Module, C.M Bhat AGM SBI , Sunny Bhat Chief Manager SBI Akhnoor and officials from other banks also participated.

During the conduct of these camps, accounts are being opened for unbanked adults under PMJDY. Further, to achieve the objective of comprehensive financial inclusion of all as envisaged under PMJDY, enrolments under Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Atal Pension Yojana (APY) are being done for the eligible beneficiaries. On-spot re-KYC was also being done for all eligible accounts (including PMJDY and non-PMJDY accounts) where re-KYC was due as on June 30, 2025, or falling due during July 01, 2025, to June 30, 2026. Also, awareness sessions on digital fraud prevention and ways to access unclaimed deposit & grievance redressal are an integral part of these camps.

Above campaign will help bring millions of unbanked/unserved individuals into the banking fold and lay the foundation for inclusive and sustainable economic growth.