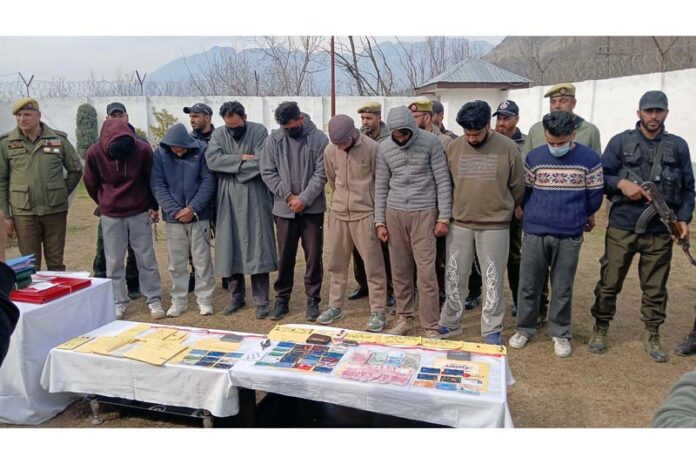

Haryana MBBS doctor among 9 arrested

Irfan Tramboo

SRINAGAR, Feb 16: Police in Ganderbal today said it has unearthed a Rs 209-Crore transnational online investment scam involving fake trading platforms and phishing websites, with the amount likely to increase as investigations continue.

Senior Superintendent of Police (SSP) Ganderbal, Khalil Ahmad Poswal, said that a Haryana-based MBBS doctor, along with eight others from Kashmir, has been arrested in connection with the fraud so far.

Follow the Daily Excelsior channel on WhatsApp

Addressing a press conference, the SSP said the case surfaced after a complaint was lodged by Firdous Ahmad Mir, son of Mohd Yousuf Mir, a resident of Safapora.

Acting on the complaint, Police Station Ganderbal registered FIR No. 08/2026 under Sections 3(5), 61(2), 316(4), 318 and 111 of the Bharatiya Nyaya Sanhita (BNS) and Section 66-C of the Information Technology Act, pertaining to identity theft and cheating by an organised gang of online fraudsters.

-Excelsior/Firdous

Subsequently, the SSP ordered the constitution of a Special Investigation Team (SIT), along with subject matter experts, to probe the case.

Police said the investigation, involving arrests, house searches and examination of bank and departmental records, revealed that fake online investment websites – including paisavault.com – were being promoted on social media and search engines to lure the public with promises of high returns through coin trading schemes.

According to police, once victims began investing on these platforms, their funds were allegedly diverted into multiple local bank accounts belonging to individuals from Budgam, Srinagar, Ganderbal, Baramulla and other areas.

Authorities stated that these accounts were reportedly controlled by the fraudsters, who swiftly transferred the money outside J&K through multiple layered transactions and, in some instances, even outside the country to evade detection.

Police have identified the alleged kingpin as Ekant Yogdutt alias “Dr. Morphine,” a resident of Hisar, Haryana.

Investigators said he had learnt the techniques while pursuing his MBBS degree in the Philippines and had established links with Chinese nationals.

According to police, Yogdutt conspired with several local associates who acted as regional heads and account mobilisers.

They have been identified as Mohd Ibrahim Shah alias Yawer from Ganderbal; Nasir Ahmad Ganie, son of Abdul Hamid Ganie, from Ganderbal; Maqsood Ahmad alias Dr. Albert from Budgam; Tanveer Ahmad alias Dr. Martin from Budgam; Tawseef Ahmad Mir, a Government teacher from Baramulla; Khurshid Ahmad from Nunner; and Ishfaq Ahmad from Safapora.

Police said these local operatives allegedly approached below poverty line (BPL) account holders and persuaded them to hand over their bank accounts and ATM cards in exchange for Rs 8,000 to Rs 10,000 per month.

The probe, police said, also indicated the suspected involvement of certain bank employees who allegedly provided QR codes linked to these accounts, which were then uploaded to the fake websites.

The accused reportedly operated Telegram channels and groups where new QR codes were regularly shared. Whenever accounts were frozen by cyber units across the country following complaints, fresh QR codes were uploaded to continue the fraudulent activity, officials said.

So far, police have gathered details of 835 bank accounts and verified transactions in 290 of them, amounting to Rs 209 crore collected from investors across India.

Officials said the total amount involved is likely to cross Rs 400 crore after complete verification.

Ekant Yogdutt was arrested by Ganderbal Police at Indira Gandhi International Airport, Delhi, while returning from China. The other eight accused were apprehended from various parts of Kashmir.

Further investigation is underway to trace the entire money trail and initiate attachment proceedings against the properties of the accused, officials said.

Police have advised the public not to fall prey to fake investment platforms promising unusually high returns and cautioned against renting out bank accounts for monetary gain.

Victims have been urged to file complaints on the National Cyber Crime Reporting Portal (cybercrime.gov.in) or contact the toll-free helpline number 1930.