Vishal Sharma

China’s unreliability as a trading partner has hit the headlines recently as it announced export curbs on rare earth magnets. Rare earth magnets are important for fossil-fuelled cars but absolutely critical for electric vehicles; they are also used in manufacturing of smart mobiles and critical defense equipments. China controls 90 % worldwide supply of these magnets and has been increasingly weaponising its supply chain dominance in this area; going as far as to use is as a geopolitical lever over its opponents.

China began using it as a strategic ploy from early April this year in response to Trump tariffs, by insisting on end-user certification process. As a part of this certification, importers are required to confirm that the imported magnets won’t be used for defence purposes or routed to the US. People associated with the process indicate that certification is a 45 day long process and it is difficult to certify in most cases the dual use nature of these magnets for obvious reasons. This has led to significant pain to automakers across the world, notably, India, the US and Europe as they face major delays in securing supplies. Indian businesses are relatively more disadvantaged given the country’s complicated ties with China, which has got even more complicated in the wake of Op Sindoor where Pakistan and China nearly fought together against India.

While US President Donald Trump and Chinese President Xi Jinping have recently agreed to continue their dialogue on the issue to ease up the supplies of rare earth magnets, China has reportedly been averse to showing similar favour to New Delhi. According to media reports, it has rejected at least two applications for India-bound shipments. Some reports indicate that a shipment to the Indian unit of a global firm was rejected by Beijing, even as it allowed exports of the same material to its German and US subsidiaries. Further, around 30 import applications have been endorsed by the Indian Government but none of the companies have been approved nor have any shipments arrived. In contrast, at least 11 applications from companies in other parts of the world have had exports restrictions eased in their favour. This should be a cause for concern for New Delhi.

Indian automakers have sought urgent talks between China and India to fast-track pending approvals and ease the onerous process, according to a May 28 presentation by the Society of Indian Automobile Manufacturers, or SIAM, to Indian Government officials. SIAM has reportedly said that none have got final approvals by China’s Ministry of Commerce in its presentation and it has warned that restrictions on magnets could lead to a crisis as the supplies could run out as early as June. Industry leaders have also been voicing concerns on the rare earth materials squeeze enforced by China. Bajaj Auto Ltd.’s Executive Director Rakesh Sharma could not have been clearer when, in an interaction with media, he is reported to have said, “Supplies and stocks are getting depleted as we speak and if there’s no relief in shipments, production will be seriously impaired in July.” TVS Motor MD, Sudarshan Venu is reported to have said that these restrictions would start pinching the Indian automotive sector by June or July. He is further quoted to have said, “The industry needs to build a strong local ecosystem for these critical materials.”

There is a clear pattern in what China has been up to: While China is expected to climb down sooner or later from its rigid position nearly in all cases in so far as other countries are concerned, it may not, or if at all it does, it may not do so without extracting something substantial in return from India. It sees India its rival- present and future; a growing economy; a country that can challenge it and at some time in future even eclipse it. In that sense India is in a different league. That is why while Beijing may soften its stand in the case of other countries, it will try and hurt India more and that too over a sustained period. What will be the price to be paid by India in this case? It is difficult to even speculate because one can’t second guess the Chinese.

India on its part has begun exploring other countries/sources for these magnets, but there aren’t many and whatever a few there may be, the quality of rare earth magnets from those sources is reportedly not comparable to that of the Chinese. Given the quality difference, their usage will surely have adverse impact on the efficiency or quality of end products, impacting bottomlines as a consequence in the long run. In the 4th meeting of the India-Central Asia Dialogue held in New Delhi on 6 June 2025 under the chairmanship of the External Affairs Minister of India, S Jaishankar, the joint statement amongst others has reference to an agreement amongst the participating countries on rare earth materials. It reads , ‘the participating countries expressed interest in joint exploration of rare earth and critical minerals. Appreciating the outcomes of the first India-Central Asia Rare Earth Forum held in September 2024 in New Delhi, they called upon the relevant authorities to hold the second India-Central Asia Rare Earth Forum meeting at the earliest convenience. The Ministers also encouraged exchange of delegations to explore new areas of cooperation in critical minerals.’ Although India is eyeing exploration of critical rare earth minerals in conjunction with central asian republics, it is not going to happen in a hurry. It is a mid term to long term enterprise. However, the Chinese hegemony on these minerals has at least forced meeting of minds of India and its friendly countries on this issue.

While it is absolutely critical to explore these minerals overseas, India should not miss the trick closer home, which is where it matters the most. India holds the world’s fifth-largest reserves of rare earth materials. India Rare Earths Limited (IREL)- the company, which manages these minerals in the country, currently lacks the capacity to produce rare earth materials on a large scale. This would have to be corrected. The onshore exploration of rare earths has to begin in real earnest now together with increasing the capacity of IREL to the levels where it not only produces these minerals for our use but also starts exporting and becomes a much bigger player in the process in this sector.

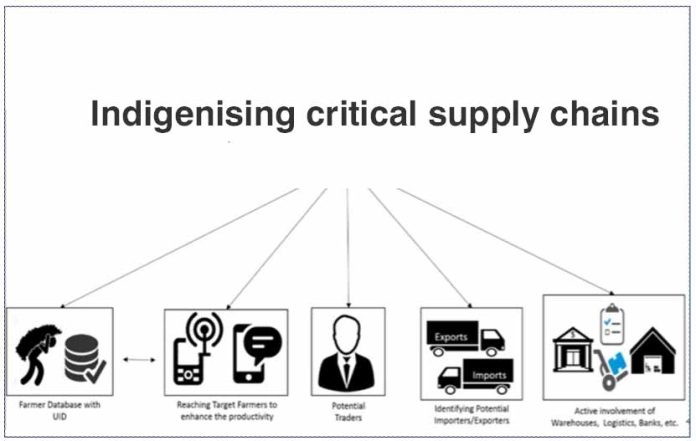

Indian businesses are also not beyond reproach, as they have refused to do the much required heavy lifting in this sector all these years. They will have to shed complacency and invest in the exploration and mass production of these minerals in the country. It is about time that the private sector also sets up enterprises to explore and refine these minerals within the country. Let there be more than one enterprise in the country in this sector. Indian businesses will have to get out of the mould of assemblers and take lead in the setting up of end to end supply chains in India. This would require private capital and a bit of patience on their behalf. But do they have any choice? Especially; as China bullies and brings their businesses to a grinding halt.

This should be a moment of stock taking for New Delhi too. This is the time to establish critical supply chains only within the geographical boundaries of India. The romance that a part of these supply chains can be set up here and the remainder sourced from outside has to end. In the near term, a mix of increased domestic capacity coupled with diversified sourcing may do the trick. But in the long term, for India strategic autonomy of supply chains is an absolutely necessity. Just imagine if there is a war and India is exposed to a blockade in Arabian Sea and in the east, near Malacca strait, and also high up in the north, how on earth it will source critical supplies required to keep fighting. As it is India does not have many friends, and in times of war, even your besties leave you. One shudders to think how New Delhi will keep up the war effort in such a situation. Most of Indian critical military systems and subsystems are less than 80 % indigenous; some even less than 40 %. China’s obduracy on rare earth magnets has a lesson for New Delhi: it must fully indigenise atleast in areas whose criticality is beyond debate. And do so, on war footing. The alternative is not even an option.